Embark on your journey into the exciting world of crypto trading with this comprehensive guide designed for beginners. Learn everything you need to know about navigating the dynamic landscape of cryptocurrencies, from understanding basic trading strategies and risk management to mastering the art of cryptocurrency analysis and selecting the right crypto exchange. This complete guide will equip you with the essential knowledge and tools to confidently enter the crypto market and make informed decisions.

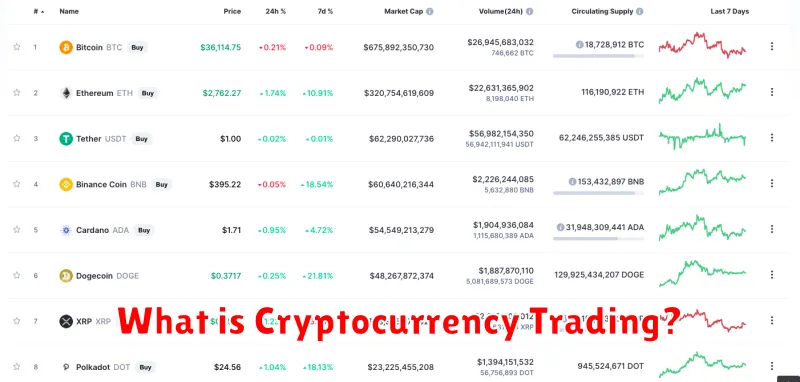

What is Cryptocurrency Trading?

Cryptocurrency trading involves buying and selling digital currencies like Bitcoin or Ethereum with the goal of making a profit. It’s similar to trading stocks, but operates on decentralized blockchain technology.

Traders aim to capitalize on price fluctuations. They buy low and sell high, hoping to profit from the difference. This can involve short-term trading (day trading) or longer-term investments (hodling).

The process involves using cryptocurrency exchanges, which are online platforms where buyers and sellers meet. These exchanges facilitate the buying, selling, and storage of cryptocurrencies.

Risks are inherent in cryptocurrency trading, as prices can be highly volatile. Understanding these risks and employing careful risk management strategies is crucial for successful trading.

Understanding Crypto Exchanges

Crypto exchanges are online platforms where you can buy, sell, and trade cryptocurrencies. They act as intermediaries, matching buyers and sellers. Think of them as stock exchanges, but for digital assets.

Choosing a reputable exchange is crucial. Look for platforms with strong security measures, high liquidity (meaning many buyers and sellers), and a user-friendly interface. Consider factors like fees, supported cryptocurrencies, and available trading options (spot trading, futures, etc.).

Security is paramount. Reputable exchanges employ robust security protocols to protect user funds and data. However, no exchange is completely immune to hacking, so it’s wise to only keep the cryptocurrency you need for immediate trading on the exchange.

Fees vary significantly between exchanges. They typically charge fees for trading, deposits, and withdrawals. Understanding these fee structures is critical to maximizing your profits.

Understanding different order types is important for effective trading. Common order types include market orders (buying or selling at the current market price) and limit orders (buying or selling at a specified price). Familiarize yourself with these to execute trades strategically.

Before using any exchange, carefully research and compare different platforms to find one that aligns with your needs and risk tolerance. Always prioritize security and understand the associated fees.

Different Types of Trading Strategies

Cryptocurrency trading offers a variety of strategies, each with its own risk and reward profile. Understanding these differences is crucial for success.

Day trading involves buying and selling assets within a single day, aiming to profit from short-term price fluctuations. It requires constant monitoring and a high tolerance for risk.

Swing trading focuses on holding assets for several days or weeks, capitalizing on medium-term price movements. This strategy generally requires less time commitment than day trading but still necessitates close market observation.

Scalping is an extremely short-term trading strategy, aiming to profit from tiny price changes. It requires rapid execution and specialized software.

Position trading involves holding assets for extended periods, often months or even years, aiming to profit from long-term growth. This is a less active strategy with potentially higher rewards but also greater risk exposure over a prolonged timeline.

Arbitrage seeks to profit from price discrepancies of the same asset across different exchanges. It requires quick execution and a deep understanding of market dynamics.

Algorithm trading (or bot trading) uses pre-programmed algorithms to execute trades automatically, aiming to capitalize on market inefficiencies. This requires programming knowledge or reliance on pre-built bots and carries inherent risks.

Choosing the right strategy depends on individual risk tolerance, time commitment, and trading experience. Thorough research and understanding of the chosen strategy are essential before implementation.

How to Analyze Market Trends

Analyzing market trends is crucial for successful crypto trading. Begin by understanding the difference between short-term and long-term trends. Short-term trends, lasting days or weeks, are ideal for day trading, while long-term trends, lasting months or years, suit investors with a longer-term perspective.

Several tools aid in trend analysis. Technical analysis uses price charts and indicators (like moving averages and RSI) to identify patterns and predict future price movements. Fundamental analysis examines factors affecting the cryptocurrency’s underlying value, such as adoption rates, technological developments, and regulatory changes. Combining both approaches provides a more comprehensive view.

Chart patterns, recognizable formations on price charts, can signal potential price reversals or continuations. Examples include head and shoulders, double tops/bottoms, and triangles. Support and resistance levels are price points where the market has historically struggled to break through, providing potential entry and exit points.

Remember that no analysis guarantees success. Crypto markets are volatile, and predictions can be wrong. Always implement risk management strategies, such as stop-loss orders, to limit potential losses. Continuous learning and adaptation are key to navigating the dynamic crypto market.

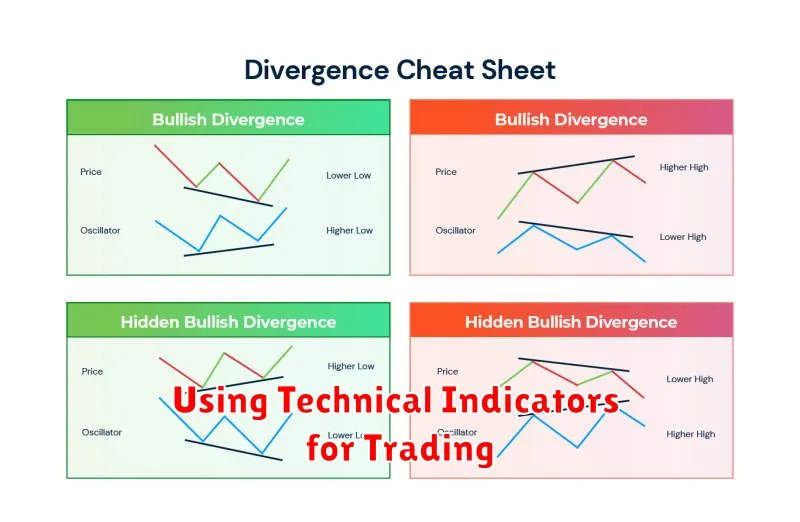

Using Technical Indicators for Trading

Technical indicators are mathematical calculations based on price and volume data, providing insights into market trends and potential trading opportunities. They are valuable tools for analyzing charts and making informed decisions, but should be used in conjunction with fundamental analysis and risk management strategies.

Moving Averages (MA) are among the most popular indicators. They smooth out price fluctuations, highlighting the overall trend. Simple Moving Average (SMA) and Exponential Moving Average (EMA) are common types, with EMAs reacting more quickly to recent price changes than SMAs.

Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Values above 70 often suggest an overbought market (potential for price reversal), while values below 30 might indicate an oversold market (potential for price increase). However, RSI divergence can also be a key signal.

MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that shows the relationship between two moving averages. Crossovers of the MACD line and signal line can suggest buy or sell signals, but should be confirmed with other indicators.

Bollinger Bands display price volatility using standard deviations from a moving average. Price bounces off the bands can be interpreted as potential support or resistance levels. Wide bands suggest high volatility, while narrow bands suggest low volatility.

It’s crucial to remember that no indicator is perfect. False signals are common, and relying solely on technical indicators can be risky. Beginners should focus on understanding a few key indicators thoroughly before incorporating more complex ones into their trading strategies. Always combine technical analysis with other forms of analysis and sound risk management.

Managing Risk and Stop-Loss Strategies

Successful crypto trading hinges on effective risk management. Never invest more than you can afford to lose. Diversification across multiple cryptocurrencies can help mitigate risk, spreading your investment across various assets to reduce the impact of any single asset’s decline.

A crucial aspect of risk management is implementing stop-loss orders. These are pre-set orders that automatically sell your cryptocurrency if the price drops to a specified level. This limits your potential losses, preventing significant damage to your portfolio in volatile markets. Setting appropriate stop-loss levels requires careful consideration of your risk tolerance and market conditions.

Position sizing is equally important. Instead of investing your entire capital in a single trade, allocate a specific percentage to each trade. This prevents catastrophic losses if a trade goes against you. A common strategy is to allocate no more than 1-5% of your capital per trade, depending on your risk tolerance.

Finally, thorough research and understanding of market trends are critical. Before entering any trade, carefully analyze the cryptocurrency’s fundamentals and technical indicators. Staying informed about market news and events can also help you make better trading decisions and manage risks more effectively.

Avoiding Common Trading Mistakes

Cryptocurrency trading, while potentially lucrative, is fraught with risks. Avoiding common mistakes is crucial for success. One major pitfall is emotional trading; letting fear and greed dictate decisions often leads to poor outcomes. Instead, stick to a well-defined trading plan based on technical and fundamental analysis.

Another prevalent error is over-diversification. While diversification is important, spreading your investments too thinly across numerous cryptocurrencies can make it difficult to track performance and capitalize on significant gains. Focus on a manageable portfolio of well-researched assets.

Ignoring risk management is another critical mistake. Never invest more than you can afford to lose. Employ strategies like stop-loss orders to limit potential losses and take-profit orders to secure profits. Regularly review and adjust your risk management strategy as market conditions evolve.

FOMO (Fear Of Missing Out) can lead to impulsive trades based on hype rather than sound analysis. Avoid chasing quick profits and instead focus on a long-term strategy that aligns with your financial goals and risk tolerance. Conduct thorough research before investing in any cryptocurrency.

Finally, lack of education is a significant obstacle. Before investing, thoroughly understand cryptocurrency fundamentals, market dynamics, and trading strategies. Continuous learning is key to staying ahead of the curve and making informed decisions. Utilize reputable educational resources and practice with a demo account before risking real capital.

Best Practices for Safe Trading

Security is paramount in crypto trading. Always use a reputable and secure exchange, enabling two-factor authentication (2FA) for enhanced protection. Store your cryptocurrency in a hardware wallet for offline security, minimizing risks associated with online exchanges.

Risk management is crucial. Never invest more than you can afford to lose. Diversify your portfolio across different cryptocurrencies to mitigate risk. Employ stop-loss orders to limit potential losses on individual trades.

Due diligence is essential before investing in any cryptocurrency. Research thoroughly, understanding the project’s whitepaper, team, and market potential. Beware of scams and pump-and-dump schemes; independently verify information before making any decisions.

Stay informed about market trends and news. Regularly monitor your investments and adjust your strategy as needed. Avoid impulsive decisions based on hype or fear; maintain a disciplined approach to trading.

Regularly review your security practices and update your software. Stay vigilant against phishing attempts and suspicious emails or messages. Remember that crypto trading involves significant risk, and losses are possible.