Choosing the right crypto wallet is crucial for securing your digital assets. This article explores the fundamental differences between hot wallets and cold wallets, two primary types of crypto storage. Understanding the trade-offs between convenience and security inherent in hot and cold storage solutions will empower you to make an informed decision about which type best suits your cryptocurrency needs and risk tolerance. We’ll examine the pros and cons of each, helping you navigate the world of digital asset security.

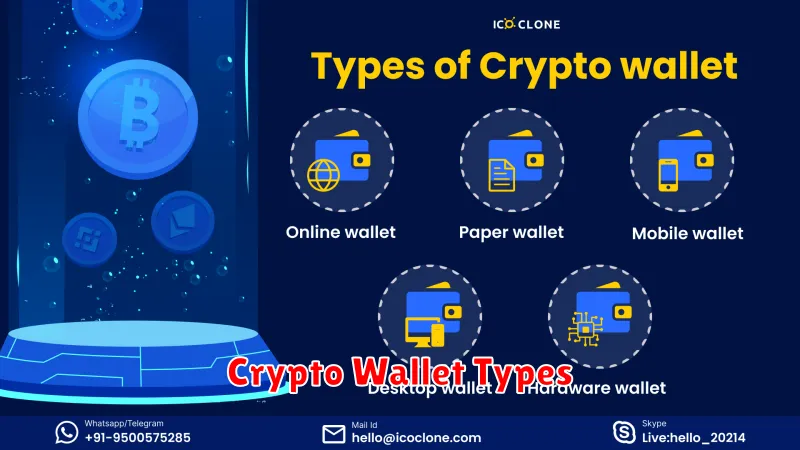

What is a Crypto Wallet?

A crypto wallet is a software program or hardware device that allows you to store, send, and receive cryptocurrencies. It doesn’t actually store the cryptocurrency itself; instead, it securely holds the private keys necessary to access and manage your digital assets on the blockchain.

Think of it like a digital bank account for cryptocurrencies. Your wallet holds your cryptographic keys, which are essentially passwords that prove your ownership of the cryptocurrencies stored on the blockchain. Different types of wallets offer varying levels of security and convenience, which we will discuss further in this article.

Choosing the right wallet depends on your individual needs and risk tolerance. Security and user-friendliness are key considerations when selecting a crypto wallet.

Hot Wallets: Convenience vs Security

Hot wallets, connected to the internet, offer unparalleled convenience. Their accessibility allows for quick and easy transactions, making them ideal for frequent users. However, this constant online connection presents a significant security risk. They are more vulnerable to hacking, malware, and phishing attacks compared to their offline counterparts.

The trade-off between usability and safety is the defining characteristic of hot wallets. While their ease of use is a major advantage for many, users must carefully weigh this against the increased potential for loss of funds due to cyber threats. Employing strong passwords, two-factor authentication, and reputable providers are crucial mitigation strategies to minimize these risks.

Ultimately, the choice of a hot wallet should be a calculated one, carefully considering individual needs and risk tolerance. Those prioritizing ease of access over absolute security may find hot wallets suitable, but robust security practices are paramount to safeguard assets.

Cold Wallets: Best for Long-Term Storage

Cold wallets, also known as offline wallets, provide the most secure way to store cryptocurrency for the long term. Because they are not connected to the internet, they are significantly less vulnerable to hacking and malware attacks compared to hot wallets.

There are various types of cold wallets, including hardware wallets and paper wallets. Hardware wallets are physical devices that store your private keys offline, offering a high level of security. Paper wallets, on the other hand, involve printing your public and private keys onto paper, offering a simple but less convenient method of storage requiring extreme care and security.

The primary benefit of using a cold wallet for long-term storage is the enhanced security. The offline nature significantly reduces the risk of theft or loss due to online vulnerabilities. While requiring more steps to access your funds, this increased security makes cold wallets ideal for holding significant cryptocurrency holdings over extended periods.

Before choosing a cold wallet, consider factors such as ease of use, security features, and the amount of cryptocurrency you intend to store. It’s crucial to understand the security implications of each type before making a decision. Proper security practices, including securely storing your seed phrase, are paramount regardless of the chosen cold wallet type.

How to Choose the Right Wallet for You

Selecting the right cryptocurrency wallet depends on your individual needs and priorities. Consider these key factors:

Security: For long-term storage of significant amounts of cryptocurrency, a cold wallet (hardware wallet) offers superior security due to its offline nature. For frequent trading, a hot wallet (software wallet) provides easier access but requires stronger security practices.

Accessibility: Hot wallets offer immediate access to your funds, ideal for frequent transactions. Cold wallets require more steps to access funds, making them less convenient for daily use.

User Friendliness: Some wallets are more intuitive than others. Consider your technical skills when choosing. Simple interfaces are available, but advanced features may require more technical knowledge.

Supported Cryptocurrencies: Ensure the wallet supports the specific cryptocurrencies you intend to store. Not all wallets support every coin or token.

Fees: Some wallets charge transaction fees, while others may be free. Compare fees before making a decision.

Ultimately, the best wallet is the one that provides the optimal balance of security, convenience, and functionality based on your personal cryptocurrency usage.

Best Practices for Keeping Your Wallet Safe

Safeguarding your cryptocurrency requires diligent adherence to best practices. Begin by choosing a reputable wallet provider with a strong security track record. Never share your seed phrase or private keys with anyone. Consider using a password manager to generate and store strong, unique passwords.

Enable two-factor authentication (2FA) whenever possible to add an extra layer of security. Regularly update your wallet software to benefit from the latest security patches. Be wary of phishing scams and never click on suspicious links or download untrusted software. Always verify the authenticity of websites and applications before interacting with them.

Store your seed phrase offline in a secure location, preferably using a hardware wallet for cold storage. Diversify your holdings across multiple wallets to mitigate the risk of a single point of failure. Regularly back up your wallet data, ensuring you store backups securely and offline.

Stay informed about emerging security threats and adopt appropriate countermeasures. Consider investing in a hardware security key for enhanced protection of your accounts and sensitive data. Practice good operational security by using strong passwords, avoiding public Wi-Fi for sensitive transactions, and regularly reviewing your wallet activity for any unusual behavior.