Navigating the volatile world of cryptocurrency trading can be daunting, especially for beginners. This article unveils the best trading strategies specifically tailored for newcomers, offering a clear path to success in the crypto market. We’ll explore effective techniques, including dollar-cost averaging, algorithmic trading, and technical analysis, equipping you with the knowledge and confidence to make informed investment decisions and potentially maximize your crypto profits while mitigating risk. Discover how to leverage these proven strategies to build a solid foundation in cryptocurrency trading.

Understanding Market Trends

Successful crypto trading hinges on understanding market trends. This involves analyzing price movements over time to identify patterns and predict future direction. Technical analysis, using charts and indicators like moving averages and RSI, helps identify short-term trends. Fundamental analysis, focusing on news, technological advancements, and regulatory changes, reveals long-term trends.

Identifying trends requires recognizing support and resistance levels, points where price finds difficulty breaking through. A bullish trend shows consistently rising prices, while a bearish trend indicates consistently falling prices. A sideways or ranging market exhibits price fluctuation within a defined range.

Trend following is a common strategy where traders capitalize on established trends. However, it’s crucial to manage risk. Trends can reverse unexpectedly, leading to losses. Diversification, stop-loss orders, and position sizing are essential risk management tools.

Beginners should start by observing market behavior before actively trading. Practice with demo accounts to build experience and refine their understanding of trend identification and risk management. Continuous learning and adaptation to market dynamics are critical for long-term success.

Day Trading vs Swing Trading

For cryptocurrency beginners, choosing between day trading and swing trading is crucial for success. Both strategies involve profiting from price fluctuations, but differ significantly in timeframe and risk.

Day trading requires constant monitoring of the market and involves executing multiple trades within a single day. This high-frequency approach demands significant time commitment, technical expertise, and risk tolerance. Profits are generated from small price movements accumulated throughout the day, but losses can quickly escalate if trades are not managed effectively. It is not recommended for beginners due to its complexity and high risk.

Swing trading, on the other hand, holds positions for several days or weeks, capitalizing on larger price swings. This less demanding strategy allows beginners to learn market dynamics at a more relaxed pace. While requiring less time commitment than day trading, thorough market analysis and risk management remain critical for success. The potential for higher profits exists with swing trading, but the holding period increases the risk of market reversals.

Ultimately, the best strategy depends on individual circumstances, risk appetite, and available time. Beginners are generally advised to start with swing trading to gain experience and understanding before considering the more demanding and risky world of day trading.

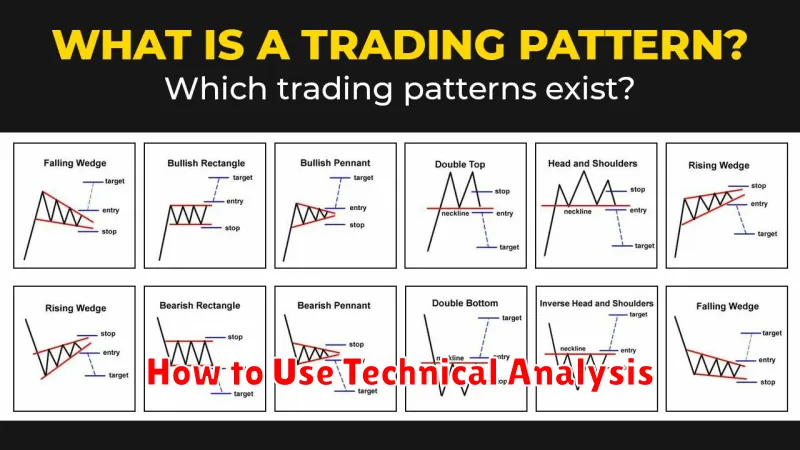

How to Use Technical Analysis

Technical analysis uses past price and volume data to predict future price movements. It’s a valuable tool for crypto beginners, but requires practice and understanding.

Begin by choosing a charting platform. Many offer free versions with essential tools. Familiarize yourself with different chart types (candlestick, bar, line) and timeframes (1-minute, daily, weekly).

Learn to identify key indicators. Moving averages (simple, exponential) smooth out price fluctuations and identify trends. Relative Strength Index (RSI) measures momentum and potential overbought/oversold conditions. MACD (Moving Average Convergence Divergence) helps identify trend changes and potential reversals.

Support and resistance levels are crucial. Support is a price level where buying pressure is expected to overcome selling pressure, while resistance is the opposite. Breakouts above resistance or below support can signal significant price movements.

Trendlines connect a series of price highs or lows to visualize the overall trend. Uptrends show rising highs and higher lows, while downtrends show declining highs and lower lows.

Practice using these tools on historical data before applying them to live trading. Backtesting strategies on past price action can help refine your approach and minimize risk.

Remember, technical analysis is not foolproof. Combine it with fundamental analysis and risk management strategies for a more comprehensive approach to crypto trading.

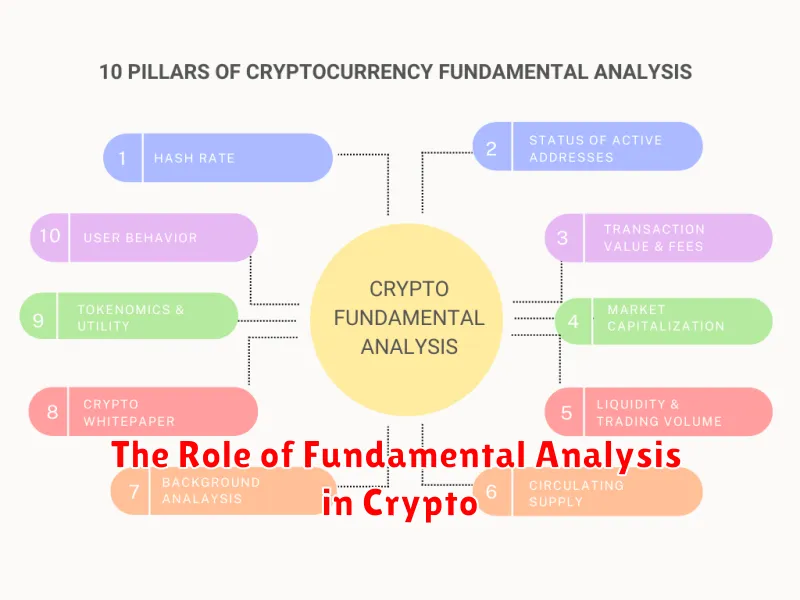

The Role of Fundamental Analysis in Crypto

Fundamental analysis in cryptocurrency trading focuses on evaluating the underlying value of a cryptocurrency. Unlike technical analysis, which looks at price charts, fundamental analysis examines factors that influence a cryptocurrency’s long-term potential.

Key aspects of fundamental analysis include assessing the project’s whitepaper for its vision, technology, and team; researching the market capitalization and circulating supply to gauge its potential for growth; analyzing the adoption rate and network activity to understand its real-world usage; and considering the regulatory landscape and potential legal challenges.

By understanding these fundamental factors, traders can make more informed decisions about which cryptocurrencies to invest in and when to buy or sell. Strong fundamentals generally indicate a higher likelihood of long-term success, although short-term price fluctuations are still possible.

It’s important to note that fundamental analysis is not a foolproof method, and its effectiveness can vary. Combining fundamental analysis with other strategies, such as technical analysis, risk management, and diversification, is recommended for a more comprehensive trading approach.

Managing Risk in Crypto Trading

Cryptocurrency trading presents significant risk due to its volatility. Effective risk management is crucial for beginners to avoid substantial losses.

A fundamental principle is diversification. Don’t put all your eggs in one basket. Invest in multiple cryptocurrencies to reduce the impact of any single asset’s price drop.

Position sizing is equally important. Never invest more than you can afford to lose. A common strategy is to limit each trade to a small percentage of your total portfolio, such as 1-5%.

Stop-loss orders are essential tools. These automatically sell your asset when it reaches a predetermined price, limiting potential losses. Setting realistic stop-loss levels is vital for effective risk mitigation.

Thorough research and understanding of the market are also paramount. Beginners should focus on learning about fundamental and technical analysis before making any trades. Never invest based solely on hype or speculation.

Finally, patience is key. The cryptocurrency market is prone to dramatic price swings. Avoid impulsive decisions and stick to your trading plan.