Navigating the volatile world of cryptocurrency requires discipline and a clear strategy. Emotional trading, driven by fear and greed, is a common pitfall that can lead to significant financial losses. This article will equip you with practical strategies to avoid emotional decision-making in your crypto investments, helping you to make rational trading choices and ultimately achieve greater success in cryptocurrency trading. Learn how to control your emotions, implement a robust trading plan, and develop a resilient mindset to thrive in this dynamic market.

What is Emotional Trading?

Emotional trading refers to making investment decisions based on feelings rather than a rational, objective analysis of market data and a well-defined trading plan. It’s driven by psychological factors like fear, greed, hope, and panic, which can lead to impulsive buys and sells.

Fear often prompts selling assets at a loss, even if the underlying fundamentals remain strong. Conversely, greed can lead to holding onto losing positions too long, hoping for a recovery, or chasing quickly rising assets without proper due diligence.

Hope, a close relative of greed, prevents investors from cutting their losses and accepting that a trade has failed. Panic, often triggered by unexpected market events, can cause irrational decisions, such as selling all assets regardless of their value or potential.

These emotional responses override logical reasoning, often resulting in poor investment outcomes and significant financial losses. Successful trading requires discipline and a commitment to a well-structured plan that minimizes the impact of emotions on decision-making.

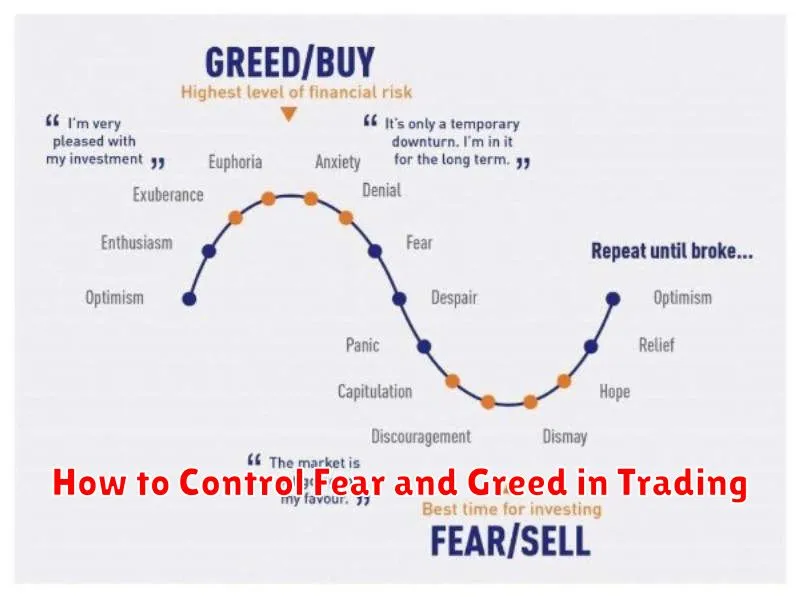

How to Control Fear and Greed in Trading

Emotional trading, driven by fear and greed, is a significant obstacle to success in cryptocurrency trading. Controlling these emotions requires a disciplined approach.

Develop a robust trading plan: This involves defining your risk tolerance, setting clear entry and exit strategies, and sticking to them regardless of market fluctuations. A well-defined plan minimizes impulsive decisions based on fear or greed.

Practice risk management: Never invest more than you can afford to lose. Utilize stop-loss orders to limit potential losses and protect your capital. This helps mitigate the impact of fear-driven panic selling.

Focus on the long term: Cryptocurrency markets are inherently volatile. Short-term price swings should not dictate your trading decisions. Maintain a long-term perspective aligned with your investment goals.

Diversify your portfolio: Don’t put all your eggs in one basket. Diversification reduces risk and helps mitigate the impact of losses in any single cryptocurrency. This decreases the likelihood of impulsive decisions driven by fear.

Regularly review your performance: Analyze your past trades, identifying both successes and failures. This self-reflection helps you understand your emotional biases and refine your trading strategy.

Maintain emotional discipline: Practice mindfulness and stress-management techniques. Consider seeking guidance from a financial advisor or therapist to better understand and manage your emotional responses to market changes. This is crucial for overcoming impulsive trading decisions fueled by fear and greed.

The Importance of Having a Trading Plan

A well-defined trading plan is crucial for mitigating emotional trading in the volatile cryptocurrency market. It provides a structured approach, reducing impulsive decisions driven by fear or greed.

Predefined entry and exit strategies are core components. These rules, based on technical or fundamental analysis, remove the need for subjective, emotional judgments in real-time. They provide clear parameters for when to buy or sell, minimizing emotional reactions to market fluctuations.

Risk management parameters, such as stop-loss orders and position sizing, are equally critical. They protect against significant losses stemming from emotional over-commitment. A trading plan should explicitly outline these safeguards to prevent excessive risk-taking in the heat of the moment.

By adhering to a documented plan, traders can maintain discipline and objectivity. This allows for a more rational assessment of market conditions, reducing the influence of emotions and improving decision-making.

Ultimately, a robust trading plan serves as a personal framework for managing trading activities, preventing emotional reactions from jeopardizing long-term investment goals. It’s an essential tool for navigating the unpredictable cryptocurrency market.

Using Stop-Loss to Manage Risk

Emotional trading in cryptocurrency can lead to significant losses. A stop-loss order is a crucial tool to mitigate this risk. It’s an instruction to your exchange to automatically sell your cryptocurrency when it reaches a predetermined price.

Setting a stop-loss order prevents impulsive decisions driven by fear or panic. If the market moves against you, your losses are automatically limited to the pre-defined amount. This helps to avoid larger losses that often result from holding on hoping for a price reversal.

Choosing the right stop-loss level requires careful consideration. It should be based on your risk tolerance and technical analysis. Some traders use a percentage-based approach (e.g., 5% below the purchase price), while others rely on chart patterns and support levels to determine their stop-loss points. The key is to find a balance that protects your capital while allowing for reasonable price fluctuations.

Remember that while a stop-loss order is a powerful risk management tool, it doesn’t eliminate the risk entirely. Market volatility and unexpected events can still impact your investment. It’s essential to combine stop-losses with other risk management strategies and sound investment practices.

Practicing Patience and Discipline

Patience and discipline are crucial for success in cryptocurrency trading. The market is volatile, and emotional decisions often lead to losses. Avoid impulsive trades driven by fear or greed.

Patience allows you to wait for the right opportunities, rather than jumping into risky trades based on short-term price fluctuations. It involves carefully researching investments and only entering the market when your analysis supports a strategic move.

Discipline means sticking to your predetermined trading plan. This includes setting stop-loss orders to limit potential losses and taking profits when your targets are met, regardless of market sentiment. It also involves resisting the urge to chase quick wins or panic sell during market downturns.

Developing patience and discipline requires consistent effort. Practice mindfulness, set realistic goals, and track your progress to identify areas for improvement. Consider keeping a trading journal to analyze your decisions and learn from your mistakes.

By cultivating these essential traits, you can significantly reduce the impact of emotions on your trading decisions and increase your chances of long-term success in the cryptocurrency market.

How to Maintain a Logical Trading Approach

Maintaining a logical trading approach in the volatile cryptocurrency market is crucial to avoid emotional decision-making. This requires a structured plan based on thorough research and a defined trading strategy.

Develop a robust trading plan that outlines your risk tolerance, entry and exit points, and stop-loss orders. This plan should be based on technical and fundamental analysis, not gut feelings. Stick to your plan; deviations should be based on updated analysis, not emotional impulses.

Diversify your portfolio to mitigate risk. Don’t put all your eggs in one basket. Spreading investments across multiple cryptocurrencies reduces the impact of individual asset volatility.

Track your progress objectively. Keep a detailed record of your trades, including profits and losses. Analyze this data to identify patterns and improve your strategy. This data-driven approach helps you understand your performance and make informed decisions, minimizing emotional bias.

Practice emotional detachment. Avoid making impulsive trades based on fear or greed. Take breaks when necessary to clear your head and maintain a rational perspective. Consider using tools that automate trading based on predetermined parameters to reduce impulsive decision-making.

Continuously learn and adapt. The cryptocurrency market is constantly evolving. Stay updated on market trends, emerging technologies, and regulatory changes. Regularly review and refine your trading plan based on new information and your trading performance.