This beginner’s guide provides a comprehensive introduction to the world of cryptocurrency. Learn about the fundamental concepts of blockchain technology, the various types of cryptocurrencies like Bitcoin and Ethereum, and how they work. We’ll explore the benefits and risks involved in investing in or using digital currencies, covering key topics such as mining, wallets, exchanges, and regulation. Whether you’re a complete novice or simply curious about this rapidly evolving landscape, this guide will equip you with the knowledge you need to understand cryptocurrency.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency designed to work as a medium of exchange. It uses cryptography to secure and verify transactions as well as to control the creation of new units of a particular cryptocurrency.

Unlike traditional currencies issued and backed by central banks, cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Transactions are recorded on a distributed ledger, often a blockchain, which is a shared, public database maintained by a network of computers.

Key features of cryptocurrencies include decentralization, transparency (though user identities may be pseudonymous), and immutability (once a transaction is recorded, it cannot be altered). Bitcoin is the most well-known example, but numerous other cryptocurrencies exist, each with its own unique characteristics and functionalities.

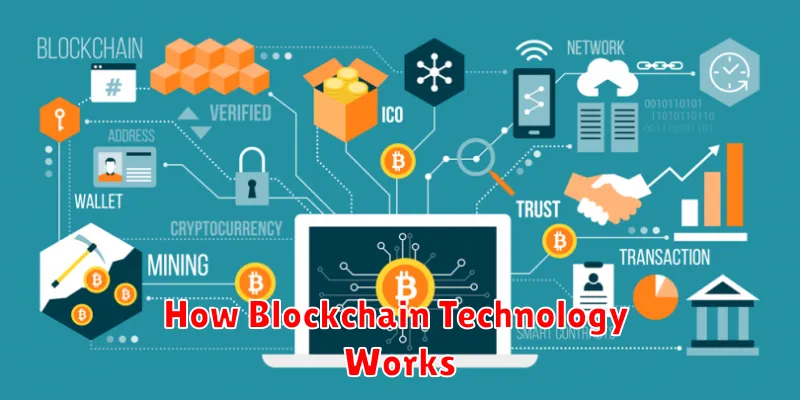

How Blockchain Technology Works

At its core, blockchain technology is a distributed, immutable ledger. Imagine a digital record book shared publicly among many computers. Each “page” in this book is a block containing a set of transactions.

When a new transaction occurs (like a cryptocurrency transfer), it’s added to a pending pool of transactions. Once a certain number of transactions are collected, they are grouped together into a new block. This block is then verified by a process called mining, where computers solve complex mathematical problems to validate the transactions’ accuracy and add the block to the chain.

The immutability comes from the fact that once a block is added to the chain, it cannot be altered or deleted. Each block is linked to the previous one using cryptographic hashing, creating a secure and transparent chain of records. This distributed nature makes it extremely difficult to tamper with the blockchain, as any change would require altering countless copies simultaneously.

This system ensures transparency, security, and trust. Because the blockchain is shared publicly, everyone can verify the transactions. The cryptographic hashing ensures the integrity of the data, and the decentralized nature makes it incredibly resilient to attacks.

Public and Private Keys Explained

Public and private keys are fundamental to how cryptocurrencies work, forming the basis of secure transactions. They are cryptographic key pairs, mathematically linked but distinct.

Your private key is a long, randomly generated string of characters. This key is incredibly important – it’s like your password to your cryptocurrency. Never share your private key with anyone. Loss of your private key means loss of access to your funds.

Your public key, on the other hand, can be shared freely. It’s derived from your private key using complex mathematical algorithms. Think of it like your bank account number; people can send you money knowing only your public key, but they can’t access your funds.

When you send cryptocurrency, your private key is used to digitally sign the transaction, proving you own the funds. The transaction is then broadcast to the network, where your public key verifies your ownership. This system ensures secure and transparent transactions.

What is a Crypto Wallet?

A crypto wallet is a software program or hardware device that allows you to store, send, and receive cryptocurrencies. It doesn’t actually hold the cryptocurrency itself; instead, it securely stores the private keys necessary to access and control your cryptocurrency holdings on the blockchain.

Think of it like a bank account, but for digital assets. Your private keys are like your bank password – keeping them safe is crucial. Losing your private keys means losing access to your cryptocurrency, and there’s no way to recover them.

There are several types of crypto wallets, each with its own advantages and disadvantages. These include software wallets (e.g., desktop, mobile, web), which are convenient but may be vulnerable to hacking if not properly secured, and hardware wallets, which offer greater security by storing your private keys offline on a physical device.

Choosing the right wallet depends on your needs and technical skills. Consider factors such as security, convenience, and the types of cryptocurrencies you plan to hold when selecting a wallet.

Crypto Mining vs. Crypto Staking

Crypto mining and crypto staking are both ways to earn cryptocurrency, but they differ significantly in their methods and requirements. Mining involves solving complex mathematical problems to verify and add transactions to the blockchain, requiring specialized hardware and significant energy consumption. The rewards are typically newly minted cryptocurrency.

Staking, on the other hand, involves locking up your existing cryptocurrency to support the network’s security and validation of transactions. This usually requires holding the cryptocurrency in a crypto wallet that supports staking. The rewards are typically a share of transaction fees or newly minted cryptocurrency, depending on the specific protocol. Staking generally requires less energy and specialized hardware than mining.

In short, mining is a resource-intensive process focused on adding new blocks to the blockchain, while staking is a more passive process that contributes to network security in exchange for rewards. The best method depends on your resources, technical expertise, and risk tolerance.

How to Buy and Sell Cryptocurrency

Buying and selling cryptocurrency involves several steps. First, you’ll need to choose a cryptocurrency exchange. These platforms allow you to buy, sell, and trade various digital currencies. Research reputable exchanges and compare fees before selecting one.

Next, you’ll need to create an account on your chosen exchange. This typically involves providing personal information and verifying your identity. Once your account is verified, you can deposit funds. Most exchanges accept bank transfers, debit/credit cards, or other payment methods.

After depositing funds, you can purchase cryptocurrency. Select the cryptocurrency you want to buy and enter the amount you wish to purchase. The exchange will then process your transaction, and the cryptocurrency will be added to your exchange wallet.

To sell your cryptocurrency, navigate to the selling section of your exchange. Select the cryptocurrency you want to sell and specify the amount. The exchange will then process your sale, and the funds will be credited to your account. You can then withdraw these funds to your bank account or leave them on the exchange for future trading.

Security is paramount. Use strong passwords, enable two-factor authentication, and be wary of phishing scams. Never share your private keys or seed phrases with anyone. Always store your cryptocurrency in a secure wallet, ideally a hardware wallet for maximum protection.

The Importance of Secure Transactions

Secure transactions are paramount in the cryptocurrency world. Unlike traditional financial systems with established regulatory frameworks and consumer protections, cryptocurrencies operate largely on decentralized networks. This necessitates robust security measures to protect users from various threats.

Privacy is a key aspect of secure transactions. Cryptographic techniques ensure that only authorized parties can access transaction details, safeguarding user data from potential breaches.

Immutability of the blockchain, a core feature of most cryptocurrencies, provides another layer of security. Once a transaction is recorded on the blockchain, it’s virtually impossible to alter or reverse, preventing fraudulent activities like double-spending.

However, security risks still exist. Users need to be aware of potential vulnerabilities, such as phishing scams, malware, and exchange hacks. Employing strong passwords, using reputable exchanges and wallets, and regularly updating software are essential steps to enhance security.

Therefore, understanding and prioritizing secure transaction practices is crucial for anyone venturing into the cryptocurrency landscape to protect their investments and personal information.

The Role of Smart Contracts in Crypto

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. They are stored on a blockchain, a decentralized and immutable ledger, ensuring transparency and security.

These contracts automatically execute when predetermined conditions are met, eliminating the need for intermediaries like lawyers or notaries. This automation leads to increased efficiency and trust, as all parties involved can verify the contract’s execution on the blockchain.

Cryptocurrencies and smart contracts are often used together. For instance, smart contracts can facilitate the automated transfer of cryptocurrency upon the fulfillment of certain conditions, such as the completion of a service or the delivery of goods. This opens up new possibilities for decentralized applications (dApps) and other innovative financial tools.

The use of smart contracts also reduces the risk of fraud and dispute, as the code is publicly auditable and the execution is transparent and verifiable. However, it’s crucial to note that vulnerabilities in the smart contract code can be exploited, highlighting the importance of thorough auditing and security best practices.

Common Crypto Scams and How to Avoid Them

The cryptocurrency world, while offering exciting opportunities, is also rife with scams. Understanding common tactics is crucial for protecting your investments.

Pump and dumps involve artificially inflating a cryptocurrency’s price through coordinated buying, then selling off large holdings at the inflated price, leaving late investors with losses. Avoid investing in coins based solely on hype or social media trends; conduct thorough research.

Phishing scams use fake websites or emails mimicking legitimate exchanges or platforms to steal login credentials and funds. Protect yourself by only accessing platforms through official websites and verifying website security (look for “https”). Never share your seed phrase or private keys.

Romance scams leverage emotional connections to trick victims into sending cryptocurrency. Be wary of unsolicited online relationships involving financial requests, especially involving cryptocurrency.

Fake celebrity endorsements use images or videos of celebrities falsely endorsing cryptocurrencies. Verify any endorsements through the celebrity’s official channels before investing.

High-yield investment programs (HYIPs) promise unrealistically high returns with little to no risk. Be skeptical of promises guaranteeing exorbitant profits; legitimate investments involve inherent risk.

Rug pulls occur when developers of a cryptocurrency project abruptly abandon the project, taking investors’ funds with them. Research the team behind a project, examining their experience and track record before investing.

Imposter scams involve fraudsters impersonating legitimate cryptocurrency exchanges or companies to solicit funds or personal information. Only communicate with official representatives through verified channels.

By remaining vigilant and employing caution, you can significantly reduce your risk of falling victim to cryptocurrency scams.

The Future of Cryptocurrency

Predicting the future of cryptocurrency is inherently challenging, but several key factors will likely shape its trajectory. Wider adoption is crucial; increased user-friendliness and regulatory clarity are needed to attract mainstream users. Technological advancements, such as improvements in scalability and energy efficiency, will be vital for broader acceptance.

The integration of cryptocurrencies into existing financial systems remains a significant question. The potential for decentralized finance (DeFi) to revolutionize traditional banking and lending is substantial, though challenges around security and regulation need addressing. Central bank digital currencies (CBDCs) may also play a significant role, potentially coexisting alongside or competing with existing cryptocurrencies.

Ultimately, the future of cryptocurrency depends on a complex interplay of technological innovation, regulatory frameworks, and market adoption. While significant uncertainty remains, the potential for cryptocurrencies to transform the financial landscape is undeniable. The evolution of crypto regulation, alongside ongoing development of robust and efficient blockchain technologies, will significantly impact the future of this emerging asset class.