Fundamental analysis is crucial for navigating the volatile world of crypto trading. Understanding a cryptocurrency’s underlying technology, team, market adoption, and regulatory landscape is paramount to making informed investment decisions. This article explores the critical role of fundamental analysis in identifying promising crypto assets and mitigating risk in this rapidly evolving market, providing a framework for successful cryptocurrency investment strategies.

What is Fundamental Analysis?

Fundamental analysis in the context of crypto trading is the process of evaluating the intrinsic value of a cryptocurrency. Unlike technical analysis which focuses on price charts and trading volume, fundamental analysis delves into the underlying factors that influence a cryptocurrency’s price.

This involves examining aspects such as the project’s technology (e.g., blockchain scalability, security features), the team behind the project (experience, reputation), the market adoption rate (number of users, transactions), the regulatory landscape (legal and compliance issues), and the overall economic environment (market sentiment, macroeconomic factors).

By assessing these fundamental factors, traders aim to determine whether a cryptocurrency is undervalued or overvalued relative to its inherent worth. This assessment informs their trading decisions, helping them to identify potentially profitable investment opportunities or to avoid risky assets.

It’s crucial to remember that fundamental analysis is not a foolproof method, and its effectiveness depends on the accuracy and completeness of the information used. External factors can still influence price regardless of a strong fundamental case. Therefore, it’s often used in conjunction with technical analysis for a more comprehensive approach to crypto trading.

How to Analyze a Crypto Project

Analyzing a crypto project requires a multifaceted approach focusing on several key areas. Begin by examining the project’s whitepaper, carefully reviewing its stated goals, technology, and tokenomics. Look for clear, achievable objectives and a well-defined roadmap.

Next, scrutinize the team behind the project. Investigate their experience, background, and reputation within the industry. A strong, experienced team significantly increases the project’s credibility.

Assess the technology underpinning the project. Is it innovative and scalable? Does it solve a real-world problem or address a significant market need? Understanding the technological merit is crucial.

Investigate the tokenomics. Understand the token’s utility, distribution, and supply. Analyze how the token’s value is intended to be maintained and its potential for future growth.

Finally, consider the community surrounding the project. A vibrant and engaged community often indicates strong support and potential for long-term success. Look for active participation on social media and community forums.

By comprehensively analyzing these five key aspects – whitepaper, team, technology, tokenomics, and community – you can gain a thorough understanding of a crypto project’s potential and make more informed investment decisions.

Evaluating a Crypto Whitepaper

A crucial aspect of fundamental analysis in cryptocurrency trading involves thoroughly evaluating crypto whitepapers. These documents outline a project’s goals, technology, and tokenomics. Careful scrutiny is essential before investing.

Begin by assessing the problem statement. Does the project address a genuine need or solve a real-world problem? A poorly defined problem suggests a weak foundation. Next, examine the proposed solution. Is it innovative, viable, and technically feasible? Look for evidence of robust research and development, including a clear explanation of the underlying technology.

Analyze the team behind the project. Their experience, expertise, and track record are crucial indicators of success. Investigate their backgrounds and look for evidence of prior successes in relevant fields. A strong team is a significant positive factor.

Thoroughly review the tokenomics. Understand the token’s utility, distribution mechanism, and overall supply. Identify potential risks associated with token inflation or deflation. A well-designed token model is vital for long-term sustainability.

Finally, consider the roadmap. Is it realistic and achievable? Are there clear milestones and timelines? A transparent roadmap demonstrates a well-planned project with a clear vision for the future. Red flags include unrealistic promises, lack of transparency, or vague timelines.

Understanding Tokenomics and Supply Mechanisms

Tokenomics refers to the economic principles governing a cryptocurrency’s supply, distribution, and value. Understanding a project’s tokenomics is crucial for fundamental analysis. It involves examining the total supply of tokens, the token distribution (how tokens are allocated among founders, investors, and the public), and the token release schedule (how tokens are released into circulation over time).

The supply mechanism describes how new tokens are created and added to the circulating supply. This can be inflationary (e.g., through mining rewards or staking rewards), deflationary (e.g., through token burning), or a hybrid model. Analyzing the supply mechanism helps predict future price movements. A consistently inflationary supply can put downward pressure on price, while a deflationary model can create scarcity and potentially drive prices higher. Understanding the rate of inflation or deflation is vital.

Token utility is another key element. How is the token used within the ecosystem? Is it used for governance, payments, access to services, or as a reward mechanism? A clear and well-defined utility often supports higher demand and value. Furthermore, the token distribution model plays a significant role in shaping market dynamics. A highly centralized distribution might present risks, while a more decentralized distribution could signal a stronger community and long-term viability.

In summary, a thorough understanding of a cryptocurrency’s tokenomics and supply mechanisms is essential for conducting a robust fundamental analysis. It provides insights into the project’s long-term sustainability, potential for growth, and overall investment viability.

How News and Events Influence Crypto Prices

Cryptocurrency markets are highly volatile, and price fluctuations are often driven by news and events. Positive news, such as regulatory approvals, major partnerships, or technological advancements, can lead to a surge in demand and subsequently, price increases. Conversely, negative news, like security breaches, regulatory crackdowns, or market manipulation allegations, can trigger sell-offs and price declines.

Market sentiment plays a crucial role. Announcements impacting investor confidence, whether positive or negative, can drastically alter the market’s perception of a particular cryptocurrency, leading to significant price swings. For example, a tweet from a prominent figure can spark a rapid increase or decrease in price, demonstrating the significant influence of social media and public perception.

Understanding the impact of news and events is vital for successful crypto trading. Fundamental analysis involves assessing these factors to predict potential price movements. Traders need to stay informed about relevant news and events and gauge their likely impact on the market. Reliable news sources and a thorough understanding of market dynamics are essential for navigating this volatile landscape.

Beyond specific news events, broader macroeconomic factors also influence crypto prices. Events like changes in interest rates, economic recessions, or geopolitical instability can significantly affect investor risk appetite and subsequently the value of cryptocurrencies.

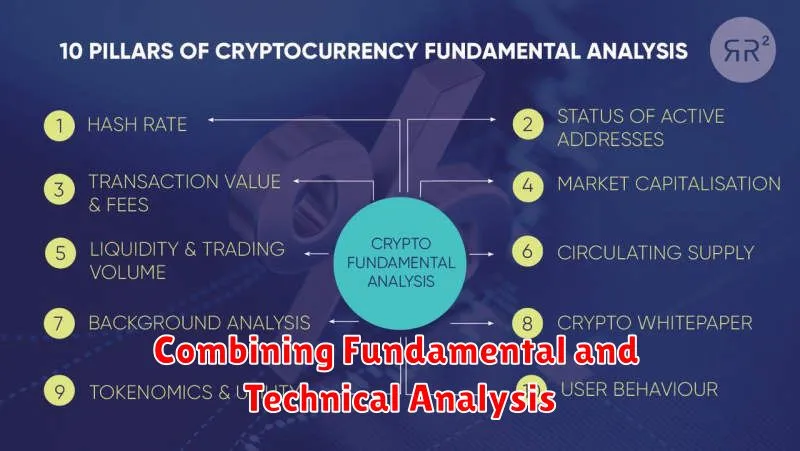

Combining Fundamental and Technical Analysis

While technical analysis focuses on price charts and trading volume to predict future price movements, fundamental analysis examines the underlying value of a cryptocurrency. Combining both approaches provides a more holistic and robust trading strategy.

Fundamental analysis helps identify cryptocurrencies with strong long-term potential. By evaluating factors such as the project’s technology, team, market adoption, and regulatory landscape, traders can determine if a cryptocurrency is undervalued or overvalued. This provides crucial context for technical analysis.

Technical analysis, on the other hand, can pinpoint optimal entry and exit points for trades. It complements fundamental analysis by identifying short-term price trends and momentum, allowing traders to capitalize on market fluctuations while aligning with their long-term fundamental assessment.

A successful combination involves using fundamental analysis to select promising cryptocurrencies and then employing technical analysis to time entries and exits effectively. For instance, a trader might identify a fundamentally strong project (using fundamental analysis) and then wait for a favorable price dip (using technical analysis) before making a purchase.

Ultimately, combining these approaches mitigates risk and enhances the likelihood of profitable trades. Fundamental analysis provides the long-term vision, while technical analysis provides the tactical execution.