Understanding the crypto market’s volatility is crucial for anyone considering investing in digital currencies. This guide will explore the factors contributing to the price swings, from regulatory uncertainty and market manipulation to the inherent speculative nature of the cryptocurrency market. We will delve into effective risk management strategies and equip you with the knowledge needed to navigate this dynamic and potentially lucrative yet volatile landscape. Learn how to analyze market trends, identify potential opportunities, and mitigate investment risks in the exciting world of crypto trading.

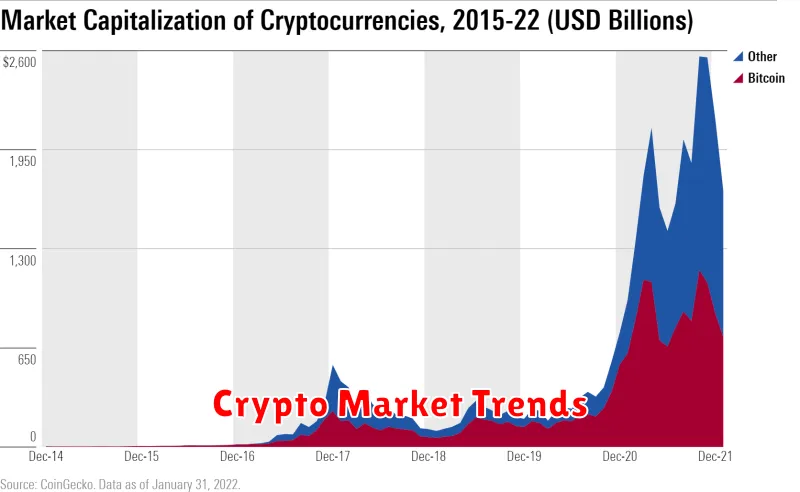

What Causes Crypto Price Fluctuations?

The cryptocurrency market is known for its volatility, with prices experiencing significant swings in short periods. Several factors contribute to these fluctuations:

Market Sentiment and Speculation: Cryptocurrency prices are heavily influenced by investor sentiment. Positive news or hype can drive prices up, while negative news or regulatory uncertainty can trigger sharp drops. Speculative trading, where investors bet on price movements rather than long-term value, further amplifies these swings.

Regulation and Government Policies: Government pronouncements and regulatory actions significantly impact cryptocurrency markets. Positive regulations can boost confidence and prices, while negative or uncertain regulatory environments can lead to sell-offs.

Technological Developments and Adoption: Advancements in blockchain technology, the development of new cryptocurrencies, and increased adoption by businesses and individuals can all influence prices. Positive developments often lead to price increases, while setbacks can result in declines.

Trading Volume and Liquidity: High trading volume can indicate strong market interest, potentially driving prices up. Conversely, low liquidity (difficulty buying or selling quickly) can lead to significant price swings during periods of increased buying or selling pressure.

Macroeconomic Factors: Broader economic conditions, such as inflation, interest rate changes, and global economic uncertainty, can also influence cryptocurrency prices. These factors often affect investor risk appetite, impacting investment flows into cryptocurrencies.

Security Concerns and Hacks: Security breaches and hacks targeting cryptocurrency exchanges or projects can negatively impact investor confidence and lead to significant price drops. News of successful attacks or vulnerabilities raises concerns about the security of the ecosystem.

How Supply and Demand Affect Prices

The cryptocurrency market, known for its volatility, is fundamentally driven by the interplay of supply and demand. Like any other asset class, the price of a cryptocurrency is determined by how much of it is available (supply) and how much people want to buy it (demand).

When demand for a cryptocurrency is high and supply is low, the price tends to rise. This is because buyers are willing to pay more to acquire the limited available coins. Conversely, when supply is high and demand is low, the price decreases as sellers compete to find buyers.

Several factors influence supply and demand in the crypto market. These include news events (positive news can boost demand, negative news can decrease it), regulatory changes, adoption rates, market sentiment, and technological advancements. Changes in any of these factors can trigger significant price fluctuations.

Understanding the dynamic relationship between supply and demand is crucial for navigating the volatile nature of the cryptocurrency market. By analyzing these forces, investors can better anticipate price movements and make more informed trading decisions.

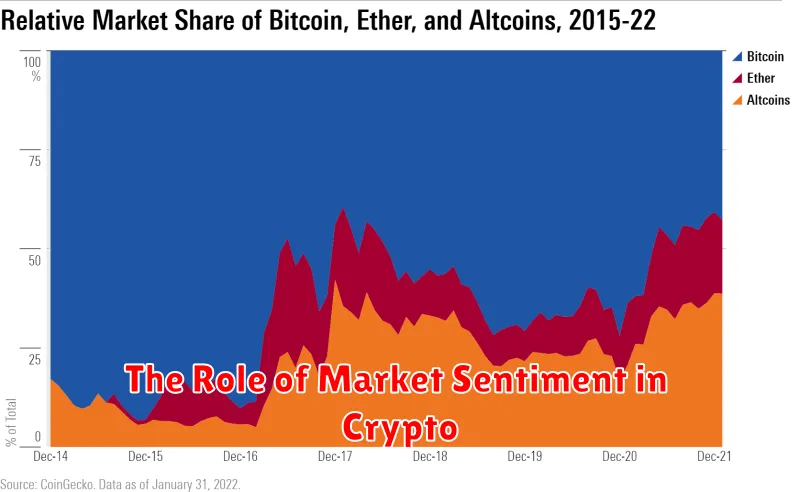

The Role of Market Sentiment in Crypto

Market sentiment, encompassing investor confidence and overall market perception, plays a crucial role in shaping cryptocurrency price volatility. It’s a powerful driver of short-term price fluctuations, often exceeding the influence of fundamental factors.

Positive sentiment, fueled by news of regulatory approvals, technological advancements, or institutional adoption, typically leads to price increases. Conversely, negative sentiment, triggered by events like regulatory crackdowns, security breaches, or prominent figure sell-offs, often causes sharp price drops.

This heightened sensitivity to sentiment stems from the relatively nascent nature of the crypto market and its high speculative element. The market’s liquidity can be thin in comparison to traditional markets, making it more susceptible to significant price swings based on even minor shifts in investor psychology.

Understanding and analyzing market sentiment, through factors such as social media trends, news coverage, and on-chain metrics, is therefore vital for navigating the volatile cryptocurrency landscape. However, it’s crucial to remember that sentiment is not a reliable predictor of long-term price trends. While it can significantly impact short-term price movements, fundamental factors ultimately determine the long-term value of cryptocurrencies.

Bitcoin Halving and Its Market Impact

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created by half. This occurs approximately every four years, significantly impacting the cryptocurrency market.

Historically, Bitcoin halvings have been followed by periods of increased price volatility. While not always immediately apparent, the halving creates a scarcity effect, reducing the supply of newly mined Bitcoin. This can lead to increased demand and, consequently, higher prices in the longer term.

However, the market’s reaction to a halving is complex and influenced by various other factors. Macroeconomic conditions, regulatory changes, and overall market sentiment all play a role in determining the price impact. Therefore, while a halving creates a fundamental shift in Bitcoin’s supply, its effect on price is not guaranteed and often delayed.

Predicting the precise market impact of a halving is impossible. Analysts often offer varying perspectives based on historical data and current market trends. However, the halving remains a significant event that investors and traders closely monitor for its potential to influence Bitcoin’s price and the wider cryptocurrency market.

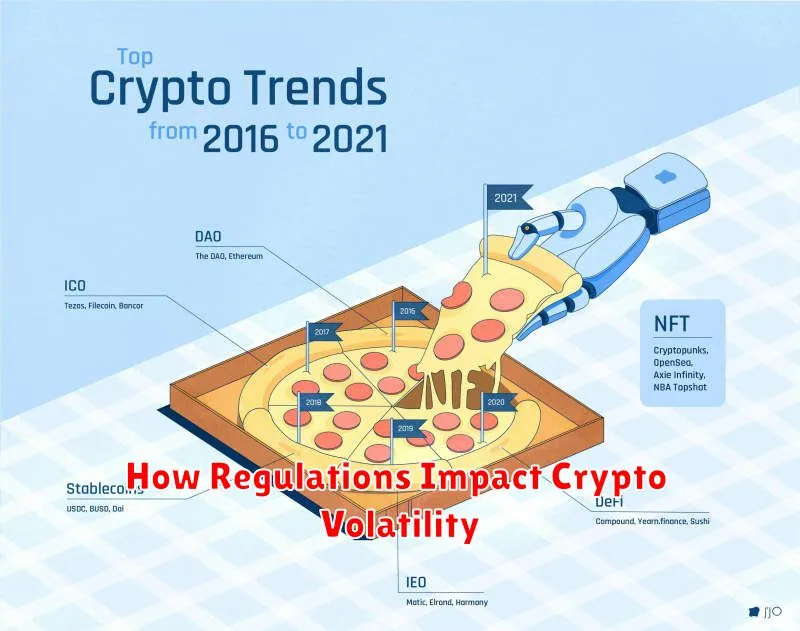

How Regulations Impact Crypto Volatility

Cryptocurrency markets are inherently volatile, but regulatory actions significantly influence this volatility. Clear and consistent regulations can foster stability by providing a framework for legitimate operations and investor protection. This can lead to reduced uncertainty and potentially lower volatility.

Conversely, uncertain or inconsistent regulatory environments can increase volatility. The anticipation of new rules, or conflicting regulations across jurisdictions, creates uncertainty that can drive speculative trading and price swings. Sudden crackdowns or bans can trigger significant sell-offs and market crashes.

The type of regulation also matters. Regulations focused on consumer protection, market integrity, and anti-money laundering (AML) can generally reduce volatility by fostering trust and transparency. However, overly restrictive regulations could stifle innovation and limit market access, potentially leading to increased volatility in the long run.

Global regulatory harmonization is crucial. A patchwork of conflicting rules across different countries creates confusion and arbitrage opportunities, exacerbating volatility. International cooperation on regulatory frameworks could help stabilize the cryptocurrency market.

In summary, the impact of regulations on crypto volatility is complex and multifaceted. While well-designed regulations can promote stability, poorly conceived or inconsistently applied rules can significantly increase price fluctuations and market uncertainty.

How to Mitigate Risks from Market Volatility

Diversification is crucial. Don’t put all your eggs in one basket. Invest in a variety of cryptocurrencies with different market caps and functionalities to reduce exposure to any single asset’s volatility.

Dollar-Cost Averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy reduces the impact of buying high and mitigates risk by averaging your purchase price over time.

Risk Tolerance Assessment is paramount. Understand your own comfort level with risk before investing. Only invest what you can afford to lose. High-risk investments come with the potential for high rewards, but also significant losses.

Stay Informed. Keep abreast of market news, technological advancements, and regulatory changes impacting the cryptocurrency market. Informed decisions minimize the impact of unexpected events.

Avoid Emotional Trading. Market volatility can trigger emotional responses, leading to impulsive decisions. Sticking to your investment strategy and avoiding panic selling is vital for long-term success.

Consider Stop-Loss Orders. These orders automatically sell your assets when they reach a predetermined price, limiting potential losses during market downturns. This requires careful planning and consideration.

Long-Term Perspective is key. Crypto markets are notoriously volatile in the short-term, but the long-term potential for growth can be substantial. Holding onto your investments during periods of volatility can yield positive results over time.

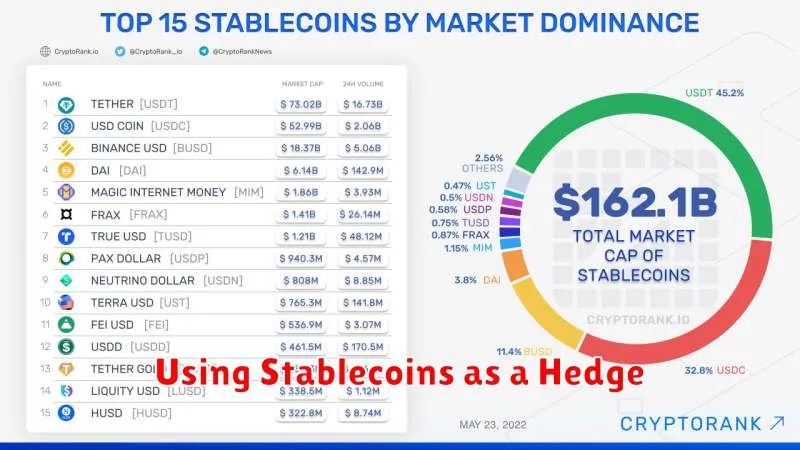

Using Stablecoins as a Hedge

Cryptocurrency markets are notorious for their volatility. Prices can swing wildly in short periods, creating significant risk for investors. One strategy to mitigate this risk is to utilize stablecoins.

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged to a fiat currency like the US dollar. This price stability offers a safe haven during periods of market turbulence. By holding a portion of your portfolio in stablecoins, you can reduce your exposure to the dramatic price fluctuations characteristic of other crypto assets.

The process is relatively straightforward. When the broader crypto market experiences a downturn, you can shift assets into stablecoins, preserving capital and avoiding further losses. Once the market stabilizes or shows signs of recovery, you can then re-allocate funds back into other cryptocurrencies to potentially capitalize on gains.

It’s important to note that while stablecoins offer a degree of risk mitigation, they are not entirely risk-free. The stability of some stablecoins depends on the underlying assets backing them, and these assets can be subject to their own risks. Therefore, careful due diligence is crucial when selecting a stablecoin for hedging purposes.

Predicting Market Trends with Technical Analysis

Technical analysis is a crucial tool for navigating the volatile cryptocurrency market. It involves studying past market data, such as price charts and trading volume, to identify patterns and predict future price movements. Unlike fundamental analysis, which focuses on a cryptocurrency’s underlying technology or adoption rate, technical analysis solely relies on price action and market sentiment reflected in the charts.

Key indicators used in technical analysis include moving averages (e.g., simple moving average, exponential moving average), which smooth out price fluctuations to reveal trends; relative strength index (RSI), which measures the magnitude of recent price changes to evaluate overbought or oversold conditions; and support and resistance levels, which represent price points where buying or selling pressure is expected to be strong.

Chart patterns, such as head and shoulders, double tops/bottoms, and triangles, also provide valuable insights. These patterns, when combined with other indicators, can offer signals for potential price reversals or continuations. It’s crucial to remember that technical analysis is not an exact science; the accuracy of predictions depends on the chosen indicators, interpretation skills, and market conditions. Therefore, combining technical analysis with other forms of analysis and risk management strategies is recommended for informed decision-making.

Despite its limitations, technical analysis remains a valuable tool for understanding market momentum, identifying potential entry and exit points, and managing risk in the unpredictable world of cryptocurrencies. Successful application requires careful study, practice, and continuous adaptation to the ever-changing market dynamics.