Building a robust and profitable crypto portfolio requires a strategic approach beyond simply buying the latest trending cryptocurrencies. This comprehensive guide on How to Create a Diversified Crypto Portfolio will equip you with the knowledge to navigate the volatile landscape of digital assets. We will explore effective portfolio diversification strategies, including asset allocation, risk management, and the importance of selecting a mix of altcoins and stablecoins to mitigate risk and maximize potential returns. Learn how to analyze market trends, understand different crypto investment strategies, and implement a long-term plan for building a truly diversified crypto portfolio that aligns with your personal financial goals and risk tolerance.

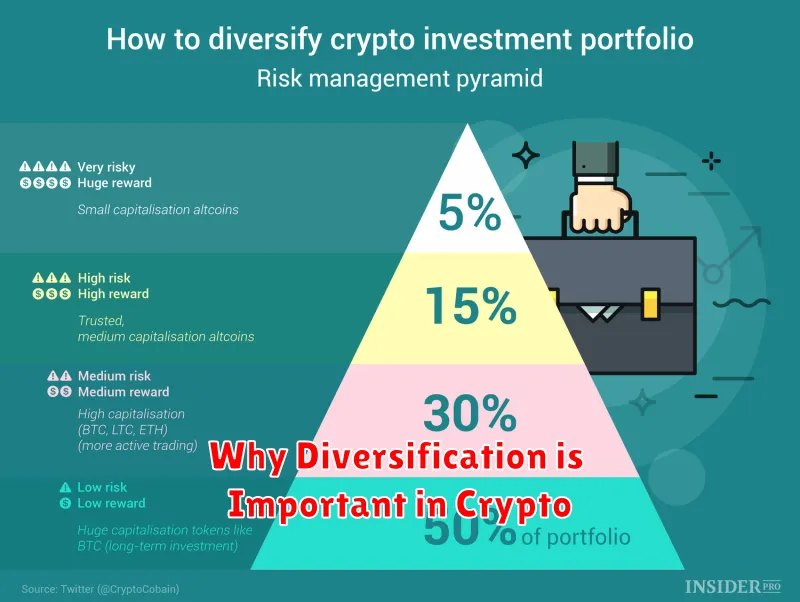

Why Diversification is Important in Crypto

Diversification in cryptocurrency is crucial for mitigating risk. The cryptocurrency market is highly volatile, with prices fluctuating dramatically in short periods. Investing in a single cryptocurrency exposes you to significant losses if that asset underperforms.

A diversified portfolio, on the other hand, spreads your investment across multiple cryptocurrencies and potentially other asset classes. This reduces your exposure to the risk associated with any one asset’s decline. If one cryptocurrency drops in value, the others in your portfolio may offset those losses.

Furthermore, diversification allows you to capitalize on the potential growth of different cryptocurrencies. Different projects have different underlying technologies, use cases, and market dynamics. By diversifying, you gain exposure to a wider range of potential returns.

In essence, diversification helps to reduce overall portfolio risk and potentially increase long-term returns. It’s a key element in any responsible cryptocurrency investment strategy.

How to Allocate Funds Across Different Assets

Allocating funds across different crypto assets requires a strategic approach based on your risk tolerance and investment goals. A common strategy is to diversify across various asset classes, including Bitcoin (BTC), Ethereum (ETH), and altcoins.

Risk tolerance is a crucial factor. Conservative investors might allocate a larger portion to established, less volatile assets like Bitcoin, while more aggressive investors may allocate more to altcoins with higher potential returns but also higher risk.

Market capitalization can be a helpful metric. Investing in larger-cap cryptocurrencies generally presents less risk than investing in smaller, less established projects. However, smaller-cap cryptocurrencies often have higher growth potential.

Consider employing a dollar-cost averaging (DCA) strategy. This involves investing a fixed amount of money at regular intervals, reducing the impact of market volatility.

It’s essential to conduct thorough research on each cryptocurrency before investing. Understand the project’s fundamentals, technology, and team behind it. Diversification doesn’t eliminate risk, but it can help to mitigate potential losses.

Finally, remember to rebalance your portfolio periodically. Market conditions change, so regularly reassessing your asset allocation and adjusting accordingly is vital to maintain your desired risk profile and investment strategy.

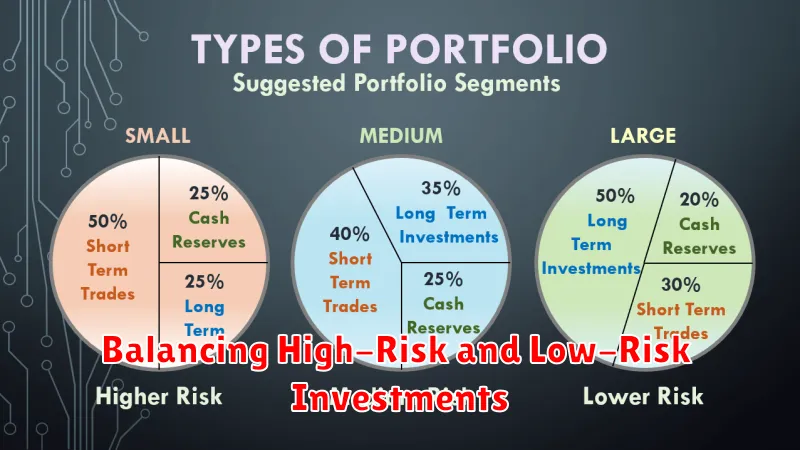

Balancing High-Risk and Low-Risk Investments

Diversification is key in any investment portfolio, and crypto is no exception. A balanced approach involves incorporating both high-risk, high-reward assets and low-risk, lower-reward assets. This strategy mitigates potential losses while still allowing for significant gains.

High-risk investments often include newer cryptocurrencies with potentially high growth but also a greater chance of substantial losses. Examples might be meme coins or tokens tied to less-established projects.

Low-risk investments generally involve established cryptocurrencies with a proven track record, such as Bitcoin and Ethereum. These assets tend to be less volatile and offer greater stability, albeit potentially slower growth compared to higher-risk options.

The optimal balance depends on individual risk tolerance and financial goals. A conservative investor might allocate a larger portion to low-risk assets, while a more aggressive investor might favor a higher proportion of high-risk investments. Careful research and understanding of market trends are crucial before making any investment decisions.

It’s important to remember that even low-risk cryptocurrencies are subject to market fluctuations. No investment is entirely risk-free. A well-diversified portfolio helps to manage and minimize risk, but it does not eliminate it.

The Role of Stablecoins in a Portfolio

Stablecoins play a crucial role in diversifying a cryptocurrency portfolio by offering stability and risk mitigation. Unlike volatile cryptocurrencies, stablecoins maintain a relatively consistent value, typically pegged to a fiat currency like the US dollar.

Their primary function is to serve as a safe haven within a portfolio. During periods of market volatility, investors can move funds into stablecoins to preserve capital and avoid further losses. This helps to reduce the overall portfolio’s risk exposure.

Furthermore, stablecoins facilitate easier portfolio management. They allow for smoother trading and rebalancing, as they provide a readily available medium of exchange without the price fluctuations associated with other crypto assets. This improves liquidity and flexibility for portfolio adjustments.

However, it’s important to note that while stablecoins offer relative stability, they are not entirely risk-free. Regulatory uncertainty and potential algorithmic vulnerabilities can impact their value. Therefore, thorough due diligence is crucial before incorporating stablecoins into a portfolio.

In conclusion, strategically incorporating stablecoins can significantly enhance the overall risk profile and management efficiency of a diversified cryptocurrency portfolio.

When to Rebalance Your Crypto Holdings

Rebalancing your crypto portfolio is crucial for maintaining your desired asset allocation and mitigating risk. There’s no single perfect schedule, but several strategies exist.

A common approach is time-based rebalancing. This involves reviewing and adjusting your portfolio at predetermined intervals, such as quarterly or annually. This ensures you consistently reallocate funds back to your target asset percentages, regardless of market fluctuations.

Alternatively, threshold-based rebalancing triggers adjustments when an asset’s weighting deviates significantly from your target allocation. For example, you might rebalance when a single asset’s percentage exceeds your target by 10% or more. This method reacts dynamically to market changes.

Market events can also necessitate rebalancing. Significant price swings or major news impacting specific cryptocurrencies may warrant an immediate review and potential adjustments to maintain your intended diversification and risk profile.

Ultimately, the optimal rebalancing strategy depends on your individual risk tolerance, investment goals, and time horizon. Consider consulting a financial advisor for personalized guidance.