This article explores the crucial role of leverage in crypto trading. We will delve into how leverage can amplify both profits and losses in the volatile cryptocurrency market, examining the risks and rewards associated with using leverage for trading Bitcoin, Ethereum, and other digital assets. Understanding leverage is paramount for any serious crypto trader seeking to maximize returns while mitigating potential financial risks.

What is Leverage in Crypto Trading?

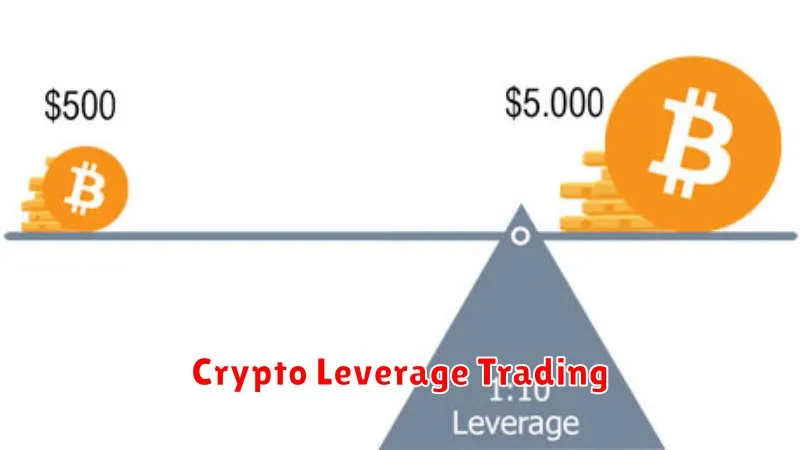

In crypto trading, leverage is a powerful tool that allows traders to control a larger position in the market than their actual account balance would normally permit. It essentially magnifies both profits and losses.

For example, a 5x leverage means that for every $100 in your account, you can control $500 worth of cryptocurrency. This can lead to significantly larger returns on successful trades. However, it’s crucial to understand that leverage also significantly amplifies losses; a small price movement against your position can quickly wipe out your account balance.

Leverage is often expressed as a multiplier (e.g., 2x, 5x, 10x, or even higher). The higher the multiplier, the greater the potential gains and the higher the risk of substantial losses.

It’s important to note that while leverage can be extremely lucrative, it’s a double-edged sword. Only experienced traders with a solid understanding of risk management should use it. Inexperienced users are strongly advised to avoid leverage altogether.

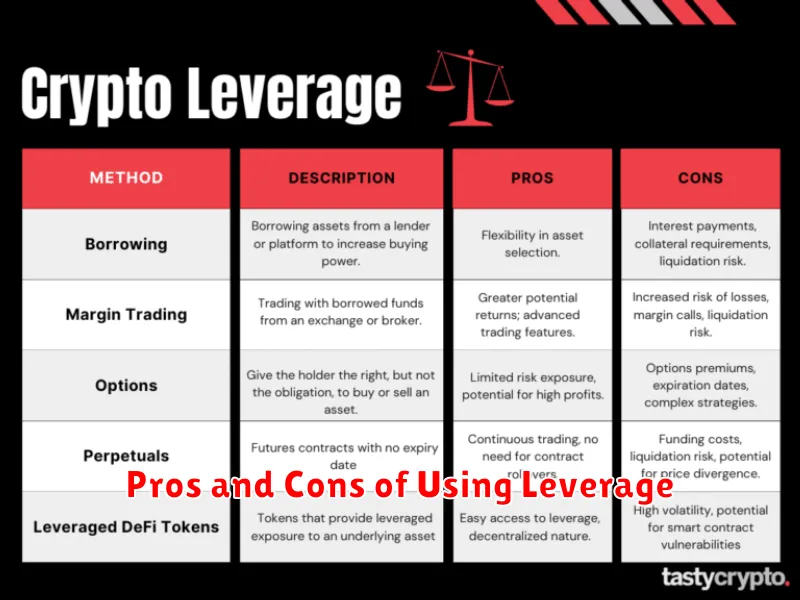

Pros and Cons of Using Leverage

Leverage in crypto trading magnifies both profits and losses. Understanding its implications is crucial for successful trading.

Pros: Leverage allows traders to amplify returns on smaller capital investments. A small price movement in the desired direction can result in significant gains. This is particularly attractive in volatile markets where quick price swings are common.

Cons: The primary drawback of leverage is the potential for substantial losses. Because leverage magnifies both gains and losses, even small market movements against your position can lead to significant losses exceeding your initial investment, a phenomenon known as margin call and potentially resulting in liquidation of your assets. Risk management becomes paramount when using leverage. The higher the leverage, the greater the risk.

Ultimately, the decision of whether or not to use leverage depends on individual risk tolerance, trading experience, and market conditions. Careful risk assessment and a well-defined trading strategy are essential when employing leverage in crypto trading.

Understanding Margin Calls and Liquidation

Leverage in crypto trading magnifies both profits and losses. Margin trading allows traders to borrow funds to increase their position size beyond their initial capital. However, this increased exposure carries significant risk.

A margin call occurs when the value of your position falls below a certain threshold, known as the maintenance margin. This triggers a demand from your exchange to deposit additional funds (margin) to cover potential losses and maintain your position.

Failure to meet a margin call results in liquidation. The exchange will automatically close a portion or all of your leveraged positions to recover the borrowed funds. This typically happens at a loss, as the exchange will sell your assets at the prevailing market price, which may be significantly lower than your entry price. The amount of the loss depends on how much the price has dropped.

Understanding margin calls and liquidation is crucial for managing risk when using leverage. Proper risk management strategies, including setting stop-loss orders and only leveraging amounts you can afford to lose, are essential to mitigate these risks.

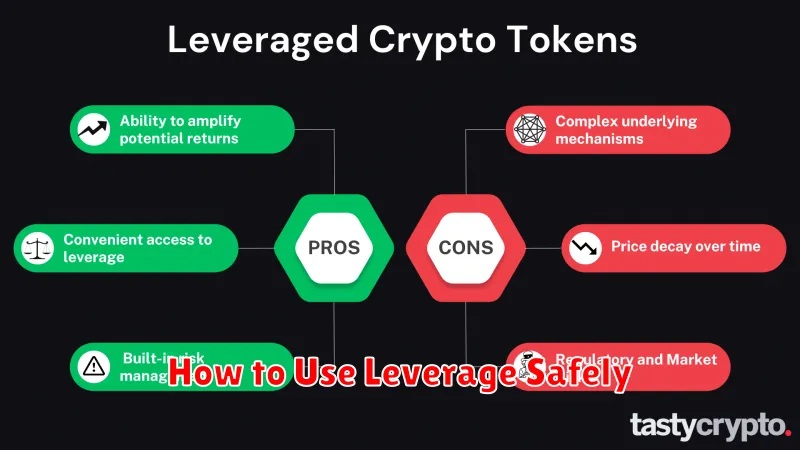

How to Use Leverage Safely

Leverage in crypto trading amplifies both profits and losses. Safe leverage usage hinges on careful risk management.

Start small. Begin with minimal leverage (e.g., 2x or 3x) to understand the mechanics and risk before increasing it.

Thorough research is crucial. Understand the asset you’re trading, market trends, and potential risks associated with leverage.

Set stop-loss orders. This limits your potential losses by automatically closing your position when the price reaches a predetermined level. Never trade without them.

Diversify your portfolio. Don’t concentrate all your leveraged trades on a single asset. Spread your risk across multiple investments.

Regularly monitor your positions and adjust your strategy as needed based on market changes. Avoid emotional trading; stick to your plan.

Only trade with funds you can afford to lose. Leverage trading carries substantial risk; never risk more than you’re comfortable losing.

Consider your trading experience. Beginners should avoid high leverage until they have a better understanding of market dynamics and risk management.

Use a demo account to practice leveraging before using real funds. This allows you to learn without risking your capital.

Understand margin calls. These occur when your losses deplete your margin, forcing the broker to liquidate your position to cover losses.

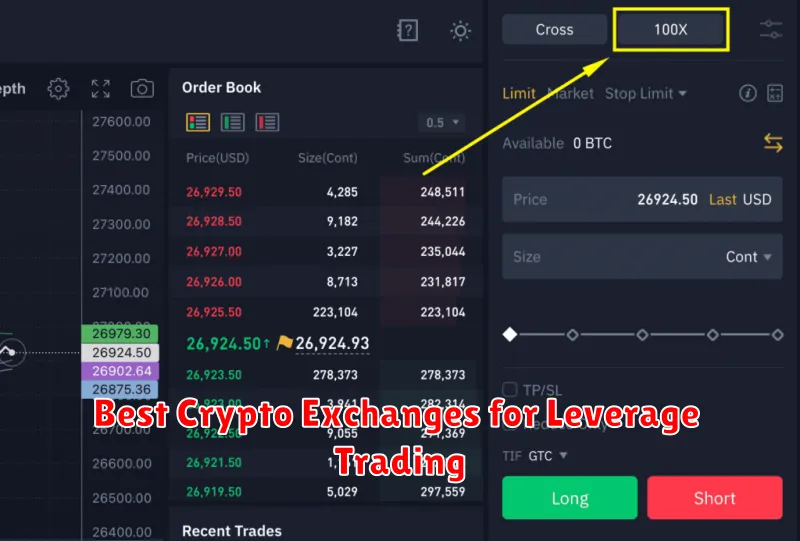

Best Crypto Exchanges for Leverage Trading

Leverage trading magnifies both profits and losses, demanding careful consideration of the platform used. Choosing the right exchange is crucial for a successful leverage trading strategy.

Binance consistently ranks highly, offering a wide range of cryptocurrencies and high leverage options, although regulatory considerations vary by region. Bybit is another popular choice known for its user-friendly interface and competitive leverage offerings, particularly for futures trading. OKX provides a similar robust platform with diverse markets and leverage capabilities.

Kraken, a more established exchange, also provides leverage trading but often with stricter requirements. BitMEX remains a significant player, especially for experienced traders seeking advanced leverage options, despite its history and evolving regulatory landscape. Remember to thoroughly research each exchange’s fees, security measures, and specific leverage limitations before engaging in trades.

The best exchange ultimately depends on individual trading styles, risk tolerance, and preferred cryptocurrencies. It’s vital to prioritize reputable exchanges with strong security features to mitigate potential risks associated with leverage trading.