Developing a profitable crypto trading strategy requires a meticulous approach, combining technical analysis, fundamental analysis, and risk management. This comprehensive guide will equip you with the knowledge and tools necessary to navigate the volatile cryptocurrency market and consistently generate profits. Learn how to identify high-potential cryptocurrencies, master chart patterns, and implement effective trading strategies to maximize your returns while mitigating risks. Discover proven techniques to build a successful crypto trading business and achieve your financial goals. We will cover topics including algorithmic trading, day trading, swing trading, and long-term investing within the cryptocurrency space.

Setting Trading Goals and Risk Tolerance

Before diving into any crypto trading strategy, establishing clear goals and a defined risk tolerance is paramount. Your goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For instance, instead of aiming to “make money,” set a goal like “achieve a 10% return on investment within six months.”

Determining your risk tolerance involves assessing how much potential loss you can comfortably accept. This is crucial for managing emotional responses during market volatility. Consider your financial situation and only invest what you can afford to lose. A common strategy is to allocate a percentage of your overall portfolio to crypto trading, rather than investing your entire savings.

Risk tolerance is intrinsically linked to your trading strategy. High-risk strategies, like day trading, require a higher tolerance for potential losses, while long-term holding strategies typically involve lower risk. Carefully weigh your goals and tolerance level before selecting a strategy to ensure they align effectively.

Regularly review and adjust your goals and risk tolerance as your experience and financial situation evolve. The cryptocurrency market is dynamic; adaptability is key to long-term success.

Choosing Between Short-Term vs Long-Term Trading

Choosing between short-term and long-term crypto trading strategies is a crucial first step in developing a profitable approach. Short-term trading, often involving day trading or swing trading, focuses on quick profits from small price fluctuations. This requires frequent monitoring, higher transaction fees, and a tolerance for greater risk. Success hinges on technical analysis skills and rapid decision-making.

In contrast, long-term trading, or investing, aims to capitalize on significant price appreciation over extended periods. It involves less frequent trading, lower transaction costs, and generally lower risk. Profitability relies on fundamental analysis, understanding market trends, and patience. The holding period can range from several months to years.

The optimal choice depends on your risk tolerance, time commitment, and financial goals. Short-term trading offers the potential for faster returns but entails higher risk, while long-term trading is generally less risky but requires greater patience. Carefully consider your individual circumstances before committing to a specific strategy.

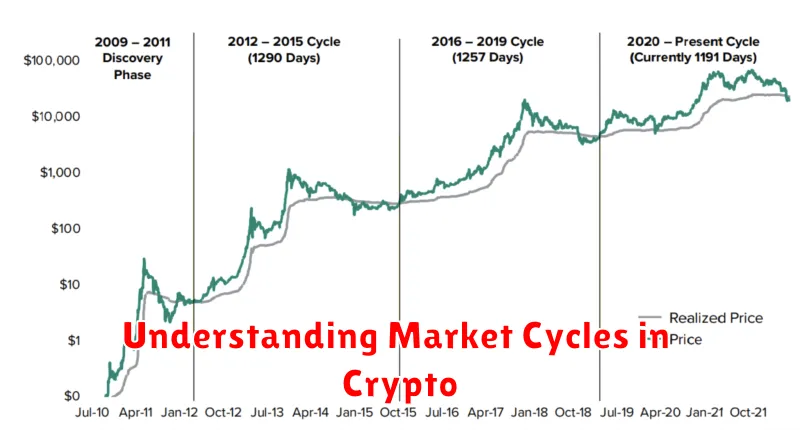

Understanding Market Cycles in Crypto

Cryptocurrency markets, like other asset classes, experience cyclical patterns. Understanding these cycles is crucial for developing a profitable trading strategy. These cycles typically involve periods of bull markets characterized by rapid price increases and significant investor enthusiasm, followed by bear markets where prices decline substantially and sentiment turns negative.

Bull markets are often driven by factors such as technological advancements, increased adoption, and positive regulatory developments. During these periods, volatility is typically high, offering opportunities for significant profits but also exposing traders to substantial losses. Identifying the early stages of a bull market is key to maximizing gains.

Bear markets, on the other hand, are characterized by decreased investor confidence, selling pressure, and price corrections. While challenging, bear markets present opportunities for accumulating assets at discounted prices for long-term investors. Understanding the factors contributing to a bear market can help traders manage risk and potentially identify attractive buying opportunities.

Recognizing these market phases requires analyzing various indicators such as price action, volume, and on-chain metrics. Technical analysis tools like moving averages and relative strength index (RSI) can provide insights into market momentum and potential trend reversals. Fundamental analysis, focusing on factors like adoption rates and technological developments, offers a broader perspective on long-term market trends.

Successfully navigating crypto market cycles requires a combination of technical and fundamental analysis, risk management strategies, and a disciplined approach to trading. A thorough understanding of market cycles is a foundational element of any profitable crypto trading strategy.

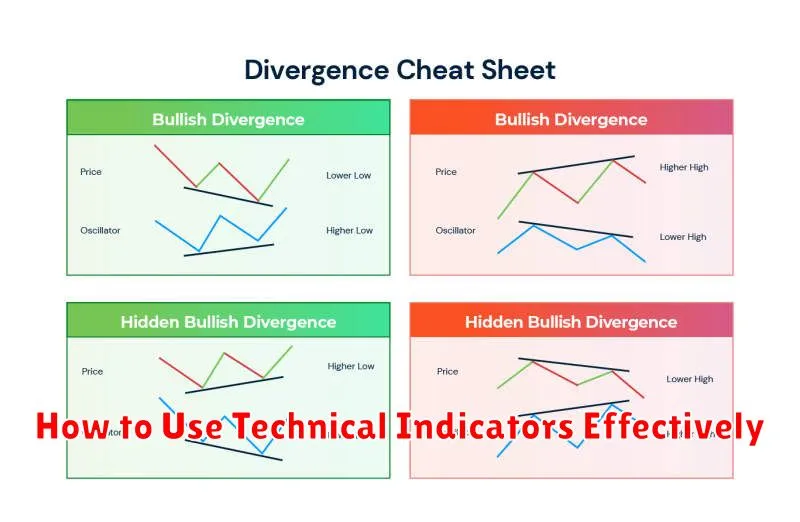

How to Use Technical Indicators Effectively

Technical indicators are valuable tools in crypto trading, but their effective use requires understanding and discipline. They shouldn’t be used in isolation; instead, they should complement your overall trading strategy and risk management plan.

Choosing the right indicators is crucial. Different indicators serve different purposes. Moving averages (e.g., simple moving average, exponential moving average) help identify trends, while oscillators (e.g., RSI, MACD) gauge momentum and potential overbought/oversold conditions. Volume indicators provide context for price movements.

Combining indicators can strengthen signal confirmation. For example, a bullish crossover on a moving average might be validated by a rising RSI above 30. However, avoid indicator overload; too many signals can lead to confusion and poor decision-making.

Context is key. Analyze indicators within the broader market context. Consider overall market sentiment, news events, and regulatory developments that might influence price action. Indicators alone cannot predict the future.

Backtesting is essential. Before relying on any indicator combination in live trading, thoroughly backtest it on historical data to assess its effectiveness and potential pitfalls. This helps refine your strategy and manage risk.

Risk management remains paramount. Even with effective indicator usage, losses are inevitable. Implement stop-loss orders and position sizing techniques to limit potential losses and protect your capital. Never invest more than you can afford to lose.

Continuous learning is vital. The crypto market is dynamic. Stay updated on new indicators, refine your existing strategies, and adapt to changing market conditions to enhance your trading performance.

Using Backtesting to Improve Your Strategy

Backtesting is a crucial step in developing a profitable crypto trading strategy. It involves simulating your trading strategy on historical data to evaluate its performance and identify potential weaknesses before risking real capital.

Effective backtesting requires a well-defined trading strategy with clearly specified entry and exit rules. You’ll need high-quality historical data, covering a sufficiently long period to account for market variations. Consider using a dedicated backtesting platform or programming tools to automate the process and enhance accuracy.

During backtesting, pay close attention to key performance indicators (KPIs) such as win rate, average win/loss ratio, maximum drawdown, and Sharpe ratio. These metrics offer insights into your strategy’s profitability, risk, and consistency.

Analyzing the results is paramount. Identify periods of strong and weak performance. Examine trades that deviated significantly from expectations and determine the contributing factors. This iterative process of testing, analysis, and refinement is vital for optimizing your strategy.

Remember that backtesting doesn’t guarantee future success. Market conditions are constantly evolving, and historical performance isn’t necessarily indicative of future results. However, thorough backtesting significantly increases your chances of developing a robust and profitable trading strategy by allowing for identification and mitigation of critical flaws before deploying it with real funds.

Building a Diversified Crypto Portfolio

A diversified crypto portfolio is crucial for mitigating risk in the volatile cryptocurrency market. Instead of investing heavily in a single asset, spread your investments across various cryptocurrencies with different market capitalizations and use cases.

Consider diversifying across several categories: large-cap cryptocurrencies (e.g., Bitcoin, Ethereum) for stability, mid-cap cryptocurrencies for potential growth, and small-cap cryptocurrencies for high-risk, high-reward opportunities. Allocate funds according to your risk tolerance and investment goals.

Asset allocation is key. There’s no one-size-fits-all approach, but a common strategy involves allocating a larger percentage to established, less volatile assets and a smaller percentage to more speculative, high-growth assets. Regularly rebalance your portfolio to maintain your desired asset allocation.

Remember to research thoroughly before investing in any cryptocurrency. Understand the project’s fundamentals, team, and technology. Diversification doesn’t eliminate risk, but it significantly reduces its impact.